Page 24 - Nexia Cape Town 2018 TG Digital

P. 24

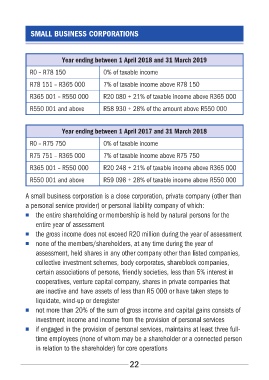

SMALL BUSINESS CORPORATIONS

Year ending between 1 April 2018 and 31 March 2019

R0 – R78 150 0% of taxable income

R78 151 – R365 000 7% of taxable income above R78 150

R365 001 – R550 000 R20 080 + 21% of taxable income above R365 000

R550 001 and above R58 930 + 28% of the amount above R550 000

Year ending between 1 April 2017 and 31 March 2018

R0 – R75 750 0% of taxable income

R75 751 – R365 000 7% of taxable income above R75 750

R365 001 – R550 000 R20 248 + 21% of taxable income above R365 000

R550 001 and above R59 098 + 28% of taxable income above R550 000

A small business corporation is a close corporation, private company (other than

a personal service provider) or personal liability company of which:

■ the entire shareholding or membership is held by natural persons for the

entire year of assessment

■ the gross income does not exceed R20 million during the year of assessment

■ none of the members/shareholders, at any time during the year of

assessment, held shares in any other company other than listed companies,

collective investment schemes, body corporates, shareblock companies,

certain associations of persons, friendly societies, less than 5% interest in

cooperatives, venture capital company, shares in private companies that

are inactive and have assets of less than R5 000 or have taken steps to

liquidate, wind-up or deregister

■ not more than 20% of the sum of gross income and capital gains consists of

investment income and income from the provision of personal services

■ if engaged in the provision of personal services, maintains at least three full-

time employees (none of whom may be a shareholder or a connected person

in relation to the shareholder) for core operations

22